As the past few years have demonstrated, the world of finance is ripe for disruption. And it’s not just cryptocurrencies that are upending this space. Among the winners of Fast Company‘s inaugural Next Big Things in Tech awards are companies that are finding new ways to eliminate age-old problems, such as Zest AI, which is tackling discrimination in lending. Others are taking on decidedly more 21st-century problems, like Mastercard, which is layering on protections for credit card transactions so they can withstand a quantum computing attack. See a list of all the Next Big Things in Tech winners here. Winners Anchorage Digital For solving crypto’s custody problem Until Anchorage came along, many institutional investors were wary of cryptocurrency on grounds relating to security and storage. The company’s digital-asset platform is designed to overcome their reservations through biometric authentication, cryptographic user keys, and hardware modules. [Illustration: Noma Bar] Grabango For letting established stores ditch checkout lines Grabango is one of many startups retrofitting stores with AI-based cashierless checkout technology. It’s focused on bringing the tech to grocers and convenience stores that may stock thousands of products—and letting them shuffle their wares around stores at will without confusing Grabango’s AI.

Mastercard For protecting payments from quantum computing attacks Quantum computing’s ability to crack existing encryption standards could pose an existential threat to existing payment systems. With its Enhanced Contactless Payments technology, Mastercard has added a layer of protection to credit card transactions that is capable of withstanding a quantum attack, but keeps the processing time to mere milliseconds.

Orum For moving money instantly Orum taps into machine learning to enable real-time payments and better predict the risk of failure when money is moved between banks. By reducing bad transactions, it saves consumers from overdraft fees and institutions from high return rates.

Zest AI For making consumer lending less racist Zest’s Fairness Kit uses adversarial de-biasing, a machine learning technique, to make consumer lending more equitable and accurate. It is being adopted by mortgage and auto lenders, along with credit unions.

Honorable Mentions NMI For enabling Android phones to accept contactless payments

Orchid For creating a crypto-powered VPN service Pilot For unlocking financial insights by applying AI to accounting

Inicia sesión para agregar comentarios

Otros mensajes en este grupo.

A new watchdog report uncovers Facebook groups quietly fueling a black market fo

A software application called Interview Coder promises to help software developers succeed at technical job interviews—by surreptitiously feeding them

Amid tariff whiplash and the rejuggling of global trade, GE Vernova’s CEO Scott Strazik is finding a way to stay “relentlessly optimistic.” Strazik returns to the Rapid Response podcast to share h

Tesla‘s electric-vehicle registrations in California dropped 15.1% during the first quarter, industry data showed, signaling an

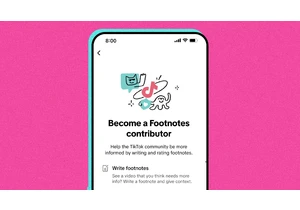

TikTok is launching its own version of community notes on the platform, called “Footnotes.”

The crowd-sourced approach to moderation, where users add additional context to p

MrBeast has again defended his philanthropy‑as‑content, clapping back at critics who say he is “only in it for the views.”

On April 13, in a post on X, Jimmy Donaldson—better k

Meta CEO Mark Zuckerberg once considered separating Instagram from its parent company due to worries about antitrust litigation, a