Plaid, which provides the technology that lets you swiftly connect your bank account to thousands of fintech products, is making the onboarding process even simpler.

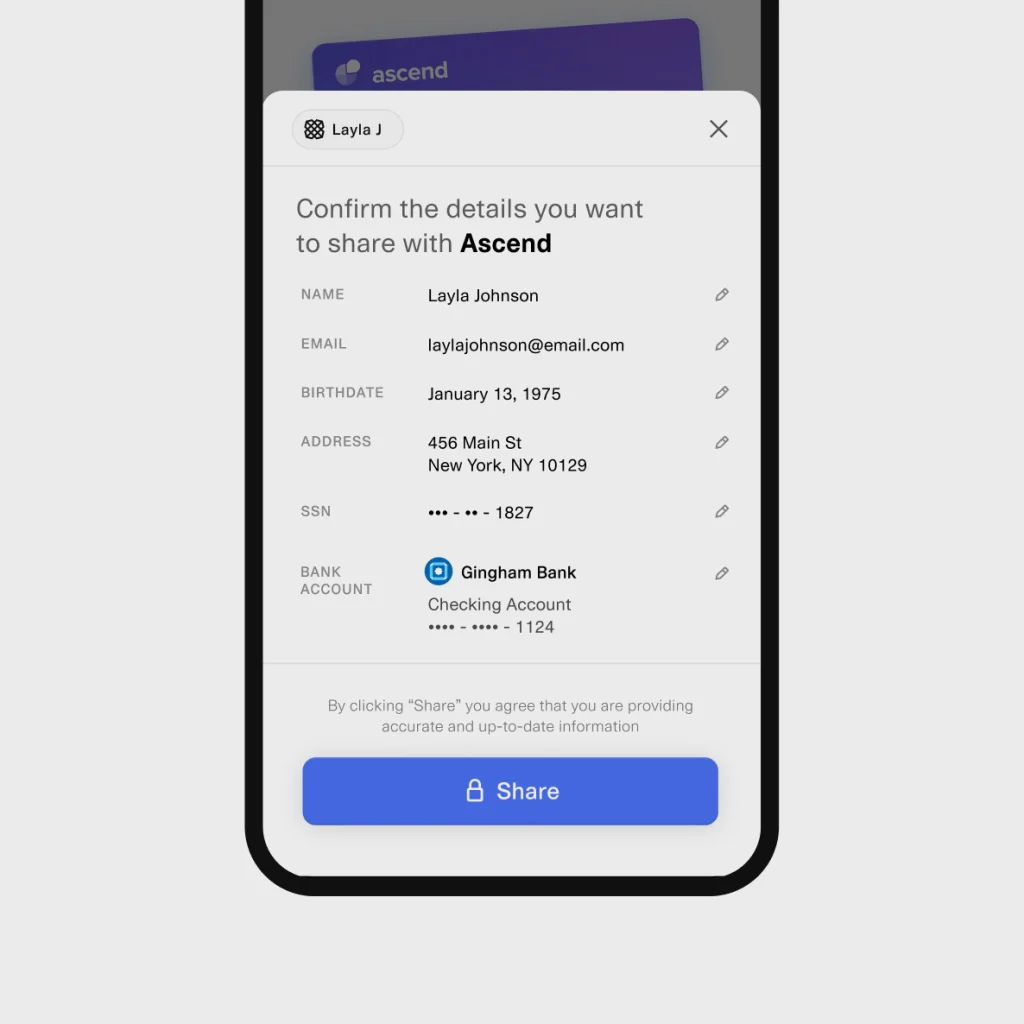

A new product called Plaid Layer will let users who’ve stored their data with Plaid set up accounts with compatible financial services and link their bank accounts in just a few clicks or taps. In many cases, they’ll simply need to provide their phone numbers and confirm their information already stored with Plaid. Financial apps using Layer can automatically populate fields like name, address, email, and Social Security number, as well as a suggested bank account to link, which users can change or tap to confirm. Financial companies can choose which data they need to receive from Plaid, and users can visit the Plaid Portal to adjust what info they let Plaid store and share.

Early testing shows Layer cuts the typical time to sign up for a new account to about 15 seconds, which represents an 87% to 90% reduction over previous signup technology, says Alain Meier, head of identity at Plaid. So far, the data also show a significant boost—between 10% and 25%—in user conversion rates for companies using Layer, thanks to the simplified signup process.

“Businesses love it, because they’re able to onboard customers much more easily, and also have more trust in these users, because they’ve been seen before in the Plaid network,” Meier says.

One early customer, lender Possible Finance, offers quick loan approvals based in part on an analysis of applicant cash flow data pulled from bank accounts via Plaid. That can be a better indicator of creditworthiness than many traditional models, says Jonny Palmer, product management director at Possible Finance.

“So we are able to welcome customers, regardless of their credit score,” he says.

So far, simplified sign ups through Plaid Layer appear to have boosted conversion and removed some friction for eligible customers who no longer have to enter their bank account and other information, Palmer says. And that’s a potential benefit to those customers, who are often searching for access to short term cash in a stressful time.

“Our industry is about reducing friction for a customer segment that ultimately doesn’t have a lot of people that are trying to reduce friction for them,” says Palmer.

When people use Plaid Layer to sign up for services on iPhone or Android devices they’ve previously used with Plaid and have already opted to save their identity information with the service, Plaid uses their phones and phone networks to authenticate that they are who they say they are..

“If you’re using your iPhone, for instance, we keep track of the fact that you used your iPhone when you last linked your bank account,” Meier says. “So then the next time you come back, we also make sure that you’re still using that iPhone that you used to originally link your bank account.”

If they’re using a web browser or new device, Plaid can trigger additional verification steps to confirm their identities, including texting codes and checking with carriers to reduce the likelihood of SIM swap attacks that hijack phone numbers, Meier says. Linking to certain banks may also require users to explicitly log in to their accounts. Users can also approve what data gets shared from their bank accounts, just as they can with existing Plaid signups, Meier says.

In the future, the tech may be used even outside of the traditional finance realm for speedy identity verification, like in filling out rental applications, Meier says.

“There’s a lot of different applications for this,” he says. “Everybody wants lower friction, everybody wants more security.”

Login to add comment

Other posts in this group

OpenAI is scouring the U.S. for sites to build a network of huge data centers to power

Ahead of Super Bowl Sunday, online privacy groups Fight for the Future and the Algorithmic Justice League are reiter

You can learn many things from TikTok, like how to make a dense bean salad or how to tell if you have “

Imagine you’re an academic researcher. You’re writing a pitch for funding to the National Science Foundation (NSF), the independent agency of the federal government that funds projects designed to