This story originally appeared in The Technology Letter and is republished here with permission.

It’s been a rough year for software stocks, and a very good year for hardware names such as Nvidia, which just hit a new all-time high, briefly, last week.

Maybe it’s time to switch.

Over the transom this afternoon came an interesting note from analysts at Jefferies & Co. pointing out the disparity between the Van Eyck Semiconductor ETF, the “SMH,” and the iShares Expanded Tech-Software ETF, the “IGV.” The analysts note since the SMH was instituted, in 2011, the past six days have seen the greatest outperformance ever by the software ETF relative to the semiconductor ETF.

“It’s no secret that software exposures are historically low while semi exposures are elevated, and this extreme move shows the pain of this unwind,” write the analysts.

Now, one data point, or six days of it, doesn’t mean that much. However, I think the idea of investors now rotating out of hardware in order to buy beaten down software names is an intriguing one. With some hardware names, such as ARM Holdings, having elevated valuations, to say the least, why not swap them for software, whose valuations are still way, way down from their elevated levels in 2021?

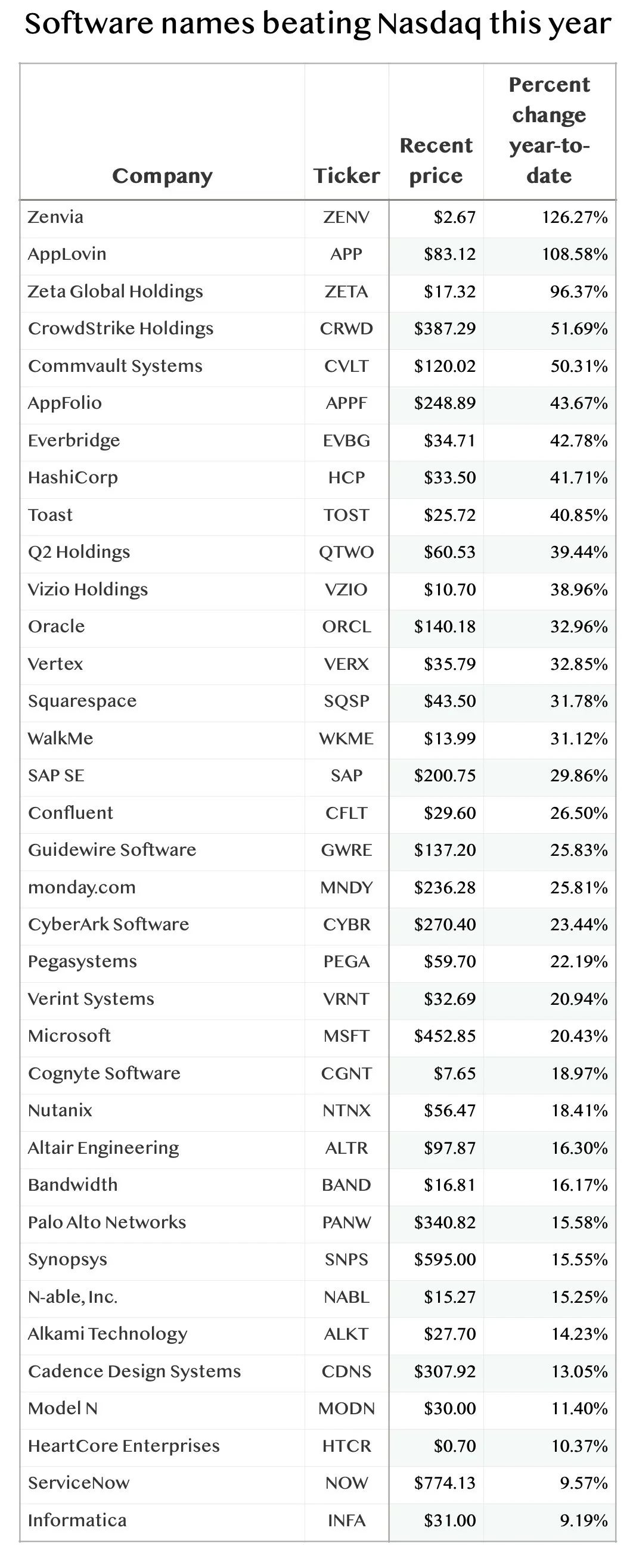

If you’re in the market for software names, one place to start is with the stocks that have beaten the Nasdaq’s 8.9% return this year. Here’s a list of 36 of them, sorted in descending order by return this year.

BETTING ON AI IN SOFTWARE AND SERVICES

The Jefferies software and services people were busy today. They also unleashed two large reports on the effects of artificial intelligence on the payments business—Visa, Mastercard, etc.—and the IT services field. On the payments side, analyst Trevor Williams argues “generative AI”—the “large language model” programs such as OpenAI’s GPT-4—can achieve a number of advances, including enhancing fraud detection, helping small businesses customize their selling (as in the case of selling software maker Block), and enhancing the customization of marketing to consumers. “Mastercard has launched Shopping Muse, a Gen AI-powered virtual shopping assistant designed to provide bespoke shopping recommendations,” is one example Williams cites.

On the IT services side, analyst Surinder Thind makes the case that “IT Services remain an under-appreciated way to gain exposure to AI.” That includes consulting firms such as Accenture, and IT off-shoring shops such as Cognizant. Thind makes the interesting argument that there are “three pillars”: AI hardware, such as Nvidia, is the “first pillar” of AI, software is the second pillar, and IT services is the third.

“The value that will be generated by the 3rd pillar has yet to be realized because the 2nd pillar is still being built,” he writes. He offers some predictions. “With each technology cycle (e.g., PC > Internet > cloud), enterprises have become more, not less reliant on IT Services companies because it is not possible for companies nowadays to maintain the requisite expertise in house,” he writes. “Not only will IT Services companies be the ones that design, develop, and implement end-to-end AI powered workflows, they will also likely build many of their own domain specific AI model that clients will come to rely on.”

Oh, also, the stocks are at decade-lows in terms of valuation, he points out, held back by the economic trends that have hurt enterprise buying of services. Thind picks Globant as his top name, the Luxembourg-based application development shop. “Our choice not only reflects the company’s track record of innovation and adaptability, but also the investments mgmt has made in building out its AI capabilities,” writes Thind, “including developing AI driven IP such as its Augoor, GeneXus, and MagnifAI products, the strategy for which was established before the current AI hype cycle.”

I’m skeptical of some of the claims of both Williams and Thind. I think it’s going to take a lot of deep thought and work to make a lot of Gen AI succeed inside corporations, more than is implied by the rosy view in both reports. We’re in the very early stages of a lot of Gen AI use by companies, and some of it will not end well at all. See points by Roger McNamee back in November on that score.

WARM GOOD FEELING FOR DATADOG

Speaking of software, shares of “DevOps” company Datadog rose by four percent on Thursday after the company held its big user conference this week. Last month, enthusiasm for the company’s integration of AI was the occasion for Merrill Lynch’s Koji Ikeda to upgrade the stock. Several analysts attending the show came away with a warm, good feeling. Stifel & Co.’s Brad Reback notes that resellers and integrators who work with the company with whom he spoke were positive on the state of customers at the moment, who have largely stopped “optimizing” their spending (meaning, cutting), and are back to “consuming,” the key word in software. “On the product front, there was significant positive commentary on Datadog’s Security suite,” he writes, “as partners highlighted several examples where Datadog’s solutions displaced smaller incumbent vendors, and even won in head-to-head greenfield deals against CrowdStrike and Wiz.”

Datadog has always been at a premium to other companies in DevOps, such as Dynatrace. At fifteen times projected next twelve months’ sales, it’s still rich, which is why one analyst recently called it too expensive. Unlike the software stocks mentioned above, Datadog has trailed the market this year, up just six percent.

QUALCOMM MAY DISAPPOINT PC HOPES

I interviewed Qualcomm CEO Cristiano Amon last month about the company’s latest foray into personal computers, as the exclusive chip supplier for the Microsoft “Copilot+ PC” computers. Not everyone is convinced this is a big coup for Qualcomm. Qualcomm is “unlikely to get any meaningful traction in PCs, and could disappoint,” according to New Street Research’s Pierre Ferragu in a note out Thursday. Ferragu’s argument is that “Intel is back at the leading edge,” meaning, Intel’s semiconductor manufacturing prowess has improved sufficiently to make it competitive to transistors made by Taiwan Semiconductor for Qualcomm, and also for Advanced Micro Devices. He therefore imagines “improved competitiveness across most key dimensions” for Intel’s newest PC chips, “Lunar Lake” and “Arrow Lake,” due out this fall. Ferragu also sees Nvidia’s rumored entry into the PC as more significant than Qualcomm’s. “Nvidia has a strong control over the gaming ecosystem, similar to Apple over Mac, and has experience in CPU design for servers (Grace) & decades in GPU design,” he observes. “Moreover, tighter integration between GPU and CPU is a powerful value proposition, especially for gaming and 3D graphic design laptops.”

All good points. I simply think the PC is a fairly moribund category of product, and so it’s an uphill climb for Qualcomm or Nvidia or anyone to take away much market share from Intel and AMD. Moribund markets don’t really get re-invented, they just fade away… Qualcomm stock is up thirty-four percent this year on a less-bad cell phone chip market and enthusiasm for the Copilot+ PC push.

This story originally appeared in The Technology Letter and is republished here with permission.

Login to add comment

Other posts in this group

Ahead of Super Bowl Sunday, online privacy groups Fight for the Future and the Algorithmic Justice League are reiter

You can learn many things from TikTok, like how to make a dense bean salad or how to tell if you have “

Imagine you’re an academic researcher. You’re writing a pitch for funding to the National Science Foundation (NSF), the independent agency of the federal government that funds projects designed to

Flashes, a photo-sharing app that’s linked to X-alternative Bluesky, launc