This story originally appeared in The Technology Letter and is republished here with permission.

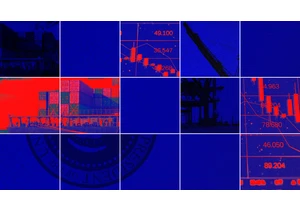

The market turmoil that has rocked tech stocks the past month, driving down the Nasdaq Composite Index nearly 8%, feels a lot to me like when I started the TL20 group of stocks two years ago: a buying opportunity.

I picked Nvidia and 19 other names back then after prices had collapsed by as much as 60% that year. The simple principle at work at that time was that stocks of good companies are worth buying when discounted.

That guideline produced an aggregate gain of 123% through Friday’s close. Even though that’s down from 179% earlier in July, it’s still more than one-and-a-half times the gain of the Nasdaq in that time.

The principle in the current market rout is the same: Good stocks are especially worthy of consideration when their valuation has been knocked down.

A survey of nearly 600 U.S.-listed tech stocks reveals 209 names with both a forward price-to-sales multiple—the enterprise value divided by expectations for sales over the next 12 months—that is lower than the ratio was six months ago, and a forward price-to-earnings (P/E) ratio that is also lower. The stocks are cheaper on both sales and profit multiples.

Out of that discounted group, 136 are also cheaper than they were a year ago by both measures. A remarkable 42 are also cheaper by both measures than they were five years ago.

If you want stability, your best bet in stock-picking is to go with higher market capitalization. In the tables below, I’ve presented the names from all three discounts—six months, one year, and five years—that have market capitalizations of $20 billion dollars or more. That is, admittedly, somewhat arbitrary, but $20 billion dollars is a good cut-off for when companies have achieved a scale in their operations that tends to give them staying power.

Below are the tables for the six-month, one-year, and five-year discounted names with market caps of $20 billion or more, sorted by market cap.

Now, having a bunch of names is just the beginning of stock-picking. The real art comes in terms of looking at further measures, such as sales and earnings growth, but also having a sense of the prospects of the business. I’ll be back tomorrow with some further thoughts on which of these names is most desirable based on those other factors.

In the meantime, feel free to download the full spreadsheet of the 212 stocks that have six-month, one-year, and/or five-year discounts, in Excel format. You can sort the columns in that table to see where each of the stocks comes up in terms of discount.

This story originally appeared in The Technology Letter and is republished here with permission.

Login to add comment

Other posts in this group

Consumers are only just starting to feel pain from Trump’s Liberation Day tariff spree. Amazon

When Donald Trump returned to the White House in 2025, many in the tech world hoped his promises to champion artificial intelligence and cut regulation would outweigh the risks of his famously vol

The first 27 satellites for Amazon’s Kuiper broadband internet constellation were launched into space from Florid

There are so many ways to die. You could fall off a cliff. A monk could light you on fire. A bat the size of a yacht could kick your head in. You’ve only just begun the game, and yet here you are,

Former Tinder CEO Renate Nyborg launched Meeno less than two years ago with the intention of it being an AI chatbot that help

The most indelible image from Donald Trump’s inauguration in January is not the image of the president taking the oath of office without his hand on the Bible. It is not the image of the First Lad

Ernest Hemingway had an influential theory about fiction that might explain a lot about a p