Scams are increasing in frequency and scope. You’re probably tired of reading about them. I’m disappointed that I need to keep writing about them. Unfortunately, none of us will catch a break any time soon. Things are likely to get worse.

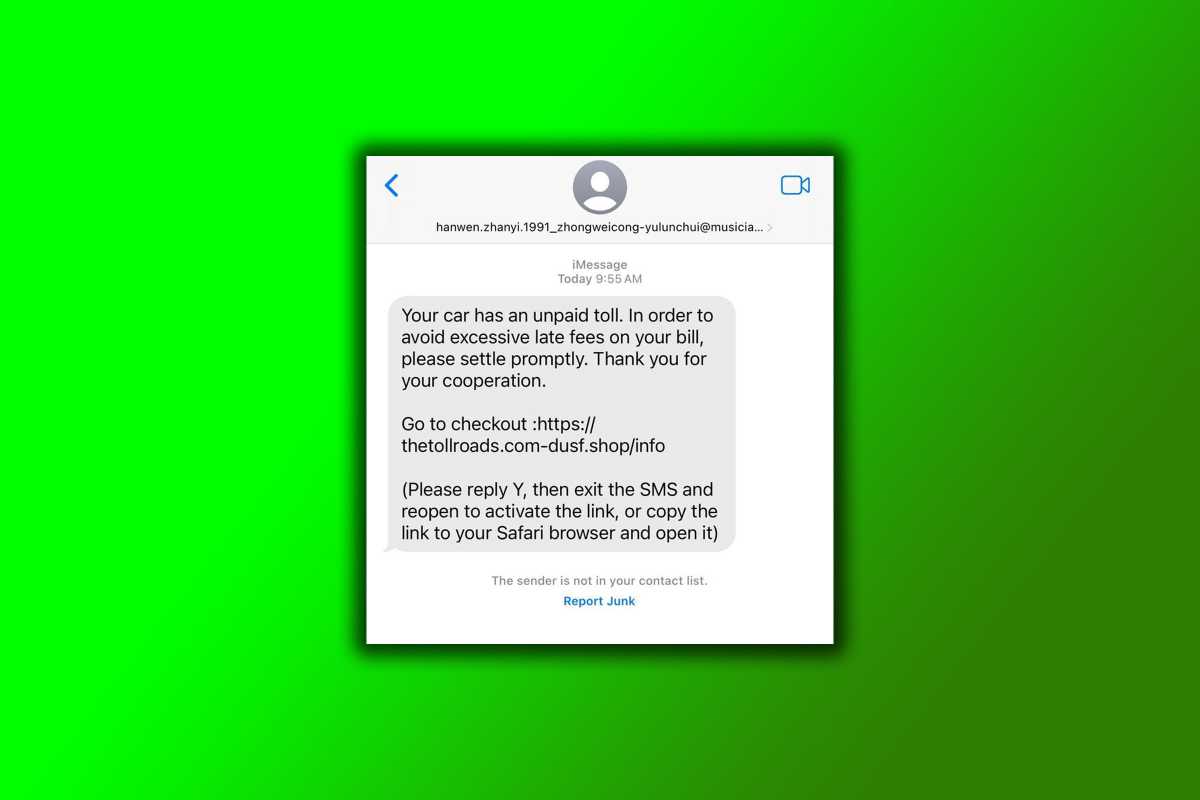

Typically, scams cast a wide net. A recent common topic has been unpaid parking tickets or tolls. However, these kinds of scams aren’t the type I’m most worried about. (I live in an urban area with good public transportation. What’s a car?) What’s far more concerning are personalized scams—ones that zero in on details of my life to trick me. And this evolved kind of scheme is set to take off as AI tools continue to improve.

It’s the number one warning that comes up when I’ve talked to cybersecurity experts in recent months. They’ve repeatedly told me that AI reduces the work of focusing on specific individuals, through better refinement and automation of their campaigns.

“[In 2025], there’s no doubt we’ll see increasingly more AI-driven attacks,” said Paige Schaffer, CEO of Iris, an identity protection service. “We already see plenty of AI-created phishing emails that look incredibly realistic, impersonating trusted individuals or companies.”

But AI also creates opportunities for fraudsters to target specific individuals instead of relying on more general tactics. “By analyzing large datasets, AI systems can help criminals identify psychological vulnerabilities (or certain individuals) more susceptible to these types of attacks and exploit their unique biases or predispositions,” said Schaffer.

Foundry

What kind of vulnerabilities? Consider this scenario presented by Abhishek Kamik, Head of Threat Research at McAfee, who says more personalized scams include those that play off of strong emotions like fear or desperation: “Imagine being one of the 36 percent of people who say they’ve gotten fake job offers, often for remote or urgent roles that seem too good to be true. If you’re not desperate for a job, you may pause and think twice before replying—but if you need to find a job to make ends meet, you may click and end up giving up personal information.”

More carefully crafted scams don’t need to be exotic or wildly detailed, either. They still involve tried and true ploys—think banking or credit card fraud—but just become far more convincing. “Thirty-seven percent of Americans have received fake alerts about supposed issues with their bank accounts or credit cards,” says Kamik. “To make things even trickier, two out of three people admit they’re not confident they could tell the difference between a voicemail created with AI and one from a real person.”

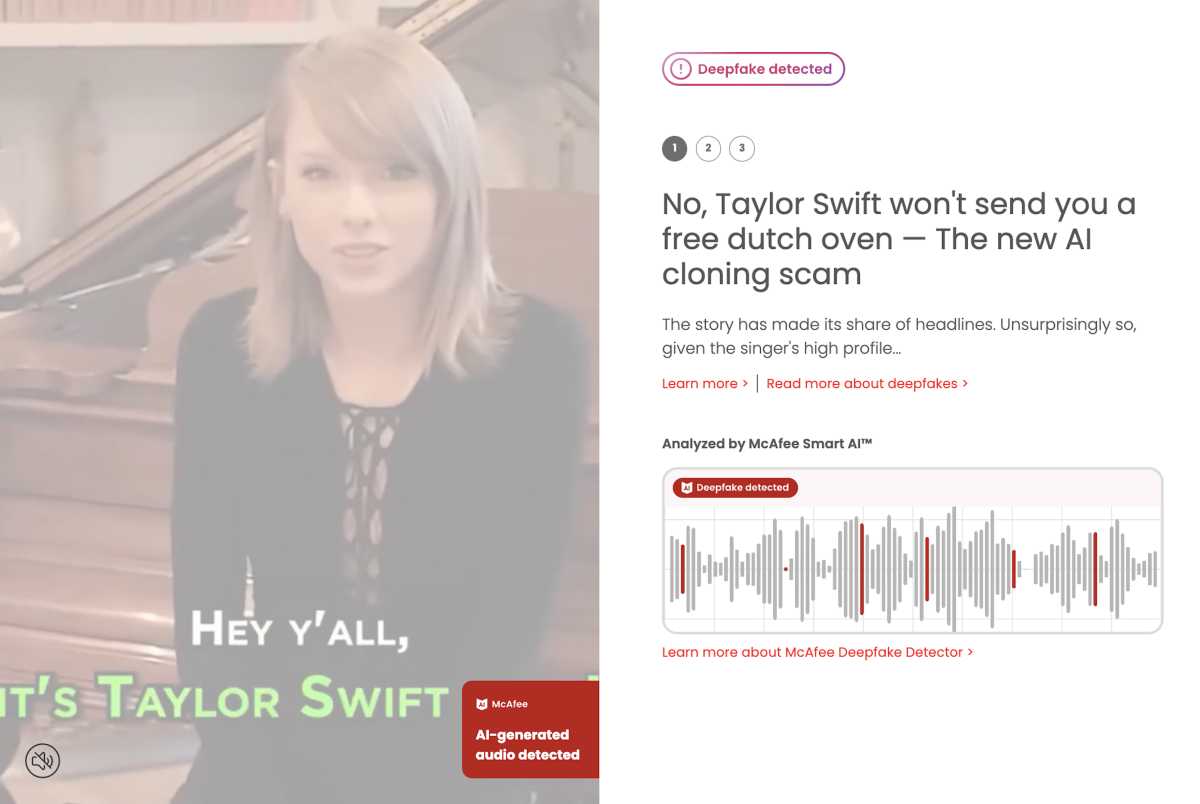

Yes, deepfake audio calls are a real thing now—and they can be spun into hyperpersonal scams. More than just impersonating the right bank when asking you to “verify” your account, such ruses go straight for the emotional jugular. They synthesize the voice of someone you love, then create audio begging for help with a desperate situation.

Further reading: How AI impersonators will wreck online security in 2025

McAfee

Fortunately, despite this increased sophistication, you can still protect yourself. The first step is knowing that scammers want your money—and that they’ll go after it through phishing attacks that steal your login information, infostealers that record everything you do (including signing into financial accounts), and ransomware that lets them extort you, as well as duping you into paying fake bills and donating to nonexistent charities.

A second big protective measure is to always stop and consider the validity of the alerts you receive. If you receive a notification about a data breach and are advised to reset your password, a quick Google search can reveal if that was in the news. Your package is delayed? Your online account should show you the package status. Bank called saying your account has been frozen? Log in (or call the number on your statements) and verify.

This can sound like a lot of work, and it can be. I find it simpler to take a blanket approach with my wariness: I immediately go directly to the source. Data breach? I open a new tab, log in, and change my password. Package is late? I skim through my email to see if I’m actually expecting a shipment. Bank account got frozen? I call the number on my statements fired up with the power of a thousand suns.

Is this slightly more work than using the provided links in an email? A little. But it’s a lot less thinking for me on busy days.

Our favorite Antivirus

Norton 360 Deluxe

As a backup, you can also look to security software. Independent antivirus software is getting its own AI shot in the arm. Companies like Norton, McAfee, Bitdefender, and others are using AI for better scam detection, including deepfakes. This level of defense isn’t bulletproof yet—not in the thorough way that antivirus software stops malware—but it’s ramping up steadily.

Fraudsters target the ordinary details of our lives, hoping no one pays close enough attention. And now that I know it’s easier for them to really nail their targets, I also know to be more vigilant. Yeah, you and I are small fries. But what we’ve got in the bank is big to us—and worth guarding.

Connectez-vous pour ajouter un commentaire

Autres messages de ce groupe

Remember when Microsoft promised that the Copilot key would be the ne

How are Intel’s customers weathering tariffs and a possible recession

I’m a big fan of gaming mice for productivity applications thanks to

The Asus Vivobook 15 is a popular choice for those who need a low-pri

Getting some extra expandable storage for your handheld gaming consol

Eufy is teeing up a pair of networked security video recorder and cam

Last week I spent a few days watching the Asus and Best Buy websites