There’s a new way to pay the bill at (some) restaurants.

Blackbird, an app launched in 2022 by serial entrepreneur Ben Leventhal, is introducing a payments feature for restaurants, potentially reducing their processing costs and changing the way diners settle up after a meal.

“The check presenter as the way people pay, as the form factor of payments, it hasn’t changed materially in a very, very long time,” Leventhal says. “If you put it in the context of all the other things that are happening in restaurants, it’s sort of a technology laggard.”

He would know. Before Blackbird, Leventhal was cofounder and CEO of Resy, the online reservations company acquired by American Express for a reported $200 million in 2019. (Amex Ventures is an investor in Blackbird.) Leventhal left the company in November 2020, promising, in a public farewell letter, to “continue fighting for the industry.”

It’s been a tough few years for restaurants. According to the National Restaurant Association, 43% of restaurants are still carrying debt accumulated during the pandemic. To Blackbird (and Leventhal), that suggests it’s time for restaurants to rethink some of the most entrenched parts of their operations.

Inside Blackbird

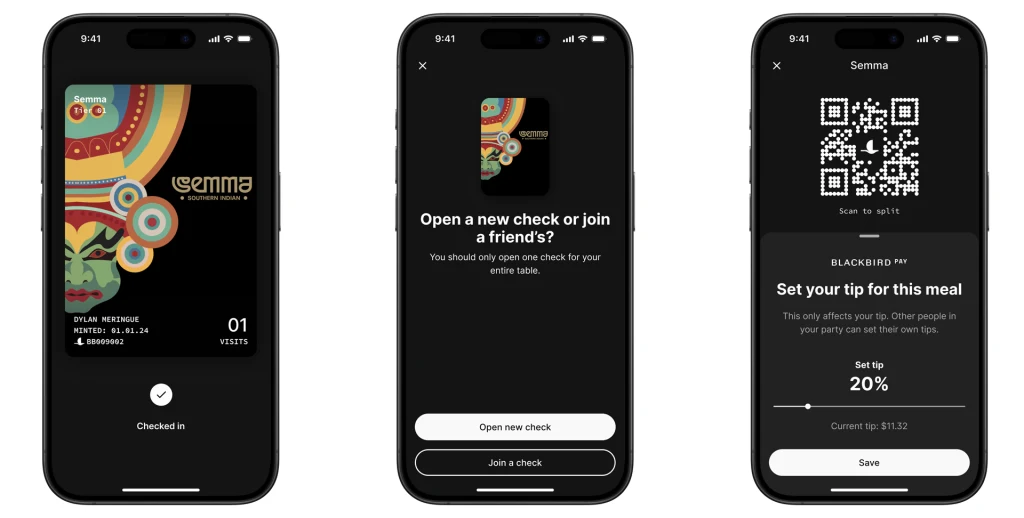

Blackbird is a guest loyalty and payments platform that wants to better connect restaurants and diners. It’s built on the blockchain, an opportunistic decision during the crypto boom of a few years ago. It uses a diner’s verified restaurant activity—visits, purchases—to give restaurants more data about their diners. And it offers diners perks for engaging with restaurants. For example, Blackbird users can text a restaurant to secure a table at the last minute. Or they can earn a free appetizer when they visit certain restaurants. And like plenty of restaurant loyalty pushes that have come before it, Blackbird gives diners points.

Most of Blackbird’s restaurants are in its hometown of New York City, including local legends like Barbuto and national names like Momofuku. It’s expanding to other cities, too, but the company won’t share a number of businesses on the platform.

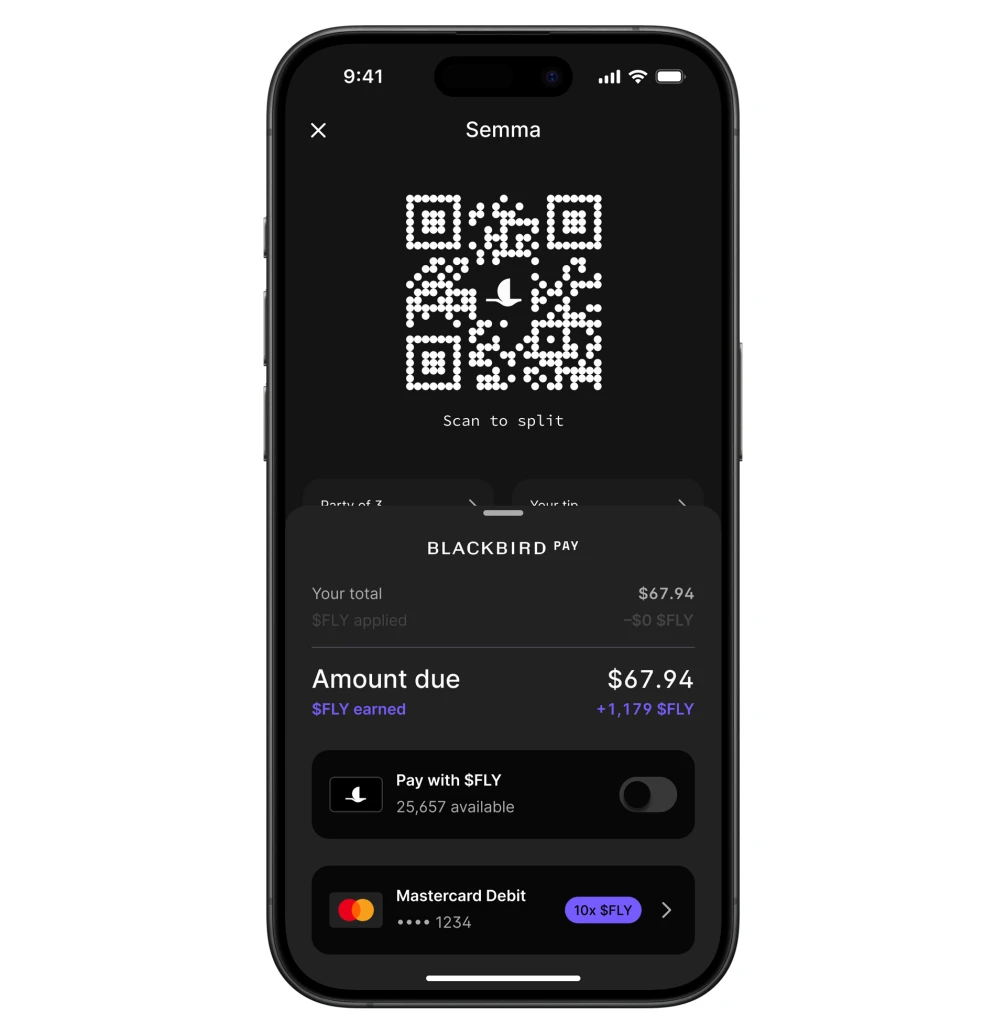

Blackbird Pay, as the newest feature is called, invites diners to pay with the app at participating restaurants, either using stored credit card information or the platform’s loyalty points. Blackbird charges restaurants a 2% processing fee per transaction, lower than standard processing fees for restaurant point of sale systems.

Restaurants can’t control these costs, Leventhal says, which gives Blackbird an opportunity. “We feel that one of the core opportunities of blockchain restaurants is to bring costs of processing way down.”

The blockchain also makes Blackbird’s points system different from other restaurant loyalty programs. Blackbird rewards diners with something called $FLY, a fungible token that lives on an L3 blockchain. “[It’s] like airline points, if airline points were 100% liquid all the time,” Leventhal says.

Loyalty, rewarded

Diners earn $FLY by checking in, and they earn extra for doing things favorable to Blackbird’s model. For example, diners get triple the $FLY rewards for sharing their personal info with the platform, like their birthday and zip code. With the launch of Blackbird Pay, diners can now also pay their bill with $FLY. After receiving payment, the restaurant can sell these tokens back to Blackbird at the current exchange rate (right now, 1 $FLY is the same as 1 cent) to receive payment in US dollars, or it can use them to reward more guests. Later this year, restaurants will be able to pay their Blackbird platform fees using $FLY. Using blockchain technology, Leventhal says, makes it easier and cheaper for Blackbird to move and process these payments.

Points-as-rewards might sound gimmicky, but they work. According to the National Restaurant Association, 84% of Millennial and Gen Z diners say they’d choose rewards over convenience, preferring a restaurant that offers points over one that doesn’t, even if it’s less convenient.

Diners on Blackbird check into a restaurant in person by tapping their phone on a Blackbird-branded NFC reader installed by the front door or host stand. This alerts the restaurant to their presence. The restaurant can see details about a guest that they’ve chosen to share (like their birthday), a history of their restaurant check-ins on Blackbird, and the amount of $FLY in their digital wallet.

Blackbird also shares a newly introduced guest value score, a numerical representation of the diner’s importance. It’s a kind of digital “Do you know who I am?”—and another reason why Blackbird wants to incentivize diners to share more about themselves.

Leventhal won’t disclose how the proprietary score is calculated, but explains that it’s not a rating or review. Blackbird’s scores are dynamic, calculated per check-in—and the guests aren’t able to see their own score. It’s based on a number of factors that Blackbird tracks, meant to represent a diner’s participation in what Leventhal calls ‘the restaurant economy.’

“The simplest example is, your score is going to be higher if you live in the neighborhood,” Leventhal says. “If two people walk in, and everything about them is the same from a spending behavior standpoint, but one person lives around the corner and the other person’s in town visiting, that’s going to drive two different scores.”

“One of the things we love about restaurants is that nothing replaces that feeling of good, in-person, old-school hospitality,” he adds. And he sees his app’s data as facilitating that kind of deeply knowledgeable service.

Assisting Hospitality

Think of what happens in the beginning, middle, and end of a meal, explains Roni Mazumdar, co-owner of the restaurant group Unapologetic Foods, which includes New York City’s Dhamaka, Semma, and Adda restaurants. A host greets a diner; the diner sits and (hopefully) enjoys a meal, and then they pay.

“The middle, that’s our job. That’s what we’re supposed to do,” he says. “[When] somebody else takes care of the stuff that has always been a bit of a hurdle”—the beginning and end of the meal, that is—”we get to do our job a little better.”

Mazumdar recalls a time when a newly hired, busy host failed to notice a restaurant regular, a person who came to one of his restaurants 52 times in two years. The diner wasn’t upset, Mazumdar says, but he was. “We felt we dropped the ball.”

Now they have outsourced that knowledge acquisition to Blackbird, signing on recently after watching the company since its inception. The act of paying via Blackbird is meant to take this a step further, by incentivizing guests to check in and earn points while giving the restaurant the most valuable dataset possible in order to provide better service.

To use Blackbird to pay the bill, a diner opens a check in the app after tapping into a restaurant. The app prompts diners to tell their server, “I’m paying with Blackbird,” something the server indicates in the restaurant’s point of sale system. Diners can pay with accumulated $FLY, stored credit or debit card, or some combination of the two. (Linking a debit card with Blackbird Pay, versus a credit card, gives diners ten times the points when they pay since debit cards are less expensive for Blackbird to process. Diners that pay in the app using $FLY earn more $FLY.) They can split the check too, though everyone at the table needs the app to participate. And at the end of the meal, there’s no check presentation. Instead, diners just get up and leave, just like they’d exit an Uber after a ride.

Built on blockchain

Blackbird isn’t the first company to try and ditch the check. Leventhal’s former company offers ResyPay, a similar feature that lets diners pay through the Resy app with stored credit card information or American Express points. Similarly, reservations platform Tock inked a deal with Chase in 2020 to let diners pay for meals with their credit card points.

Leventhal says Blackbird’s form factor sets it apart, including how $FLY works as both an incentive and currency. He explained the decision to use blockchain as taking advantage of the best available technology, while also leaving the door open to future growth. If other people want to build things on top of Blackbird or in collaboration with it, they can.

Of course, its crypto association has also helped Blackbird raise a total of $35 million over two rounds of funding from investors that include crypto-friendly a16z, fintech investor QED, and New York’s Union Square Ventures.

But for Blackbird to truly take off, it needs to appeal to even more diners and restaurants beyond its home turf in New York. The company is currently working to expand in Charleston, South Carolina, and San Francisco, with plans to serve restaurants in more cities, too.

As with the launch of Resy before it, Blackbird has targeted popular restaurants to help it grow. The premise is simple: When you make it easier for people to experience the restaurants they really want to go to, the crowds will probably follow. (Plenty of restaurant tech companies use this strategy to elevate their products; most recently, OpenTable introduced a new tier of restaurants, dubbed “icons,” in order to show off its prestige collection of customers.)

Leventhal’s own reputation in New York’s restaurant circles doesn’t hurt, either. “Past performance doesn’t always indicate future success, but Ben’s pretty smart,” said Jeff Bell, owner of New York’s Crif Dogs and adjacent speakeasy cocktail lounge PDT, both Blackbird customers. “I think this is something that captures the back-end of the guest experience better than any other platform that’s existed before.”

It’s in Blackbird’s best interest to keep diners spending on its platform and ensure they’re sharing the most data with restaurants. Looking ahead, Leventhal teases rewards for diners who carry high $FLY balances, like earned interest, with the understanding that storing value inside the app can encourage more restaurant transactions. Eventually, Blackbird might allow $FLY to serve as payment for other industries.

“[Restaurants] have to figure out how to deliver hospitality in an environment where competition is increasing. There are more restaurants around the corner from you, and they’re getting more sophisticated,” he explains. “If you’re not getting sophisticated, too, you’re probably playing with a disadvantage.”

Accedi per aggiungere un commento

Altri post in questo gruppo

Consumers are only just starting to feel pain from Trump’s Liberation Day tariff spree. Amazon

When Donald Trump returned to the White House in 2025, many in the tech world hoped his promises to champion artificial intelligence and cut regulation would outweigh the risks of his famously vol

The first 27 satellites for Amazon’s Kuiper broadband internet constellation were launched into space from Florid

There are so many ways to die. You could fall off a cliff. A monk could light you on fire. A bat the size of a yacht could kick your head in. You’ve only just begun the game, and yet here you are,

Former Tinder CEO Renate Nyborg launched Meeno less than two years ago with the intention of it being an AI chatbot that help

The most indelible image from Donald Trump’s inauguration in January is not the image of the president taking the oath of office without his hand on the Bible. It is not the image of the First Lad

Ernest Hemingway had an influential theory about fiction that might explain a lot about a p