Capital One launched on Wednesday a free, integrated subscription management tool, allowing customers to track, block, and cancel recurring payments from over 10,000 merchants directly through its mobile app.

The new tool should come as welcome relief for the many Americans who find themselves struggling to keep track of recurring payments. Whether it’s streaming services, fitness apps, or meal delivery subscriptions, automated charges can easily go unnoticed. In fact, a 2022 survey found that the average American spends $133 more on recurring payments per month.

“By embedding subscription management directly into our mobile app, we ensure that all Capital One cardholders have everything they need to manage their financial lives in one place and at no additional cost,” says Matt Knise, SVP of Premium Experiences at Capital One, in an email interview.

The tool is tied to other money management features, like proactive spend alerts, which notify users of unusual activity and offer real-time visibility into spending. Knise adds that updating card information with popular recurring merchants has also been streamlined.

A Solution to “Set It and Forget It Spend”

While subscription services provide convenience, many consumers set up payments and forget about them. This “set it and forget it spend” is a growing pain point for customers, Knise says.

“Consumers are often unaware of just how much they’re spending on these recurring services,” he adds. “We believe that transparency encourages more mindful spending, enabling users to see exactly where their money is going and take action on unused or unnecessary subscriptions with just a few taps.”

As the subscription economy continues to grow, projected to reach $1.5 trillion by 2025, canceling services remains a pain point for many consumers. Companies often make unsubscribing difficult, employing hurdles like multiple cancellation steps or written requests.

In response, the Federal Trade Commission proposed a “click to cancel” rule in 2023, while the White House’s new “Time is Money” initiative also plans to tackle unfair subscription practices.

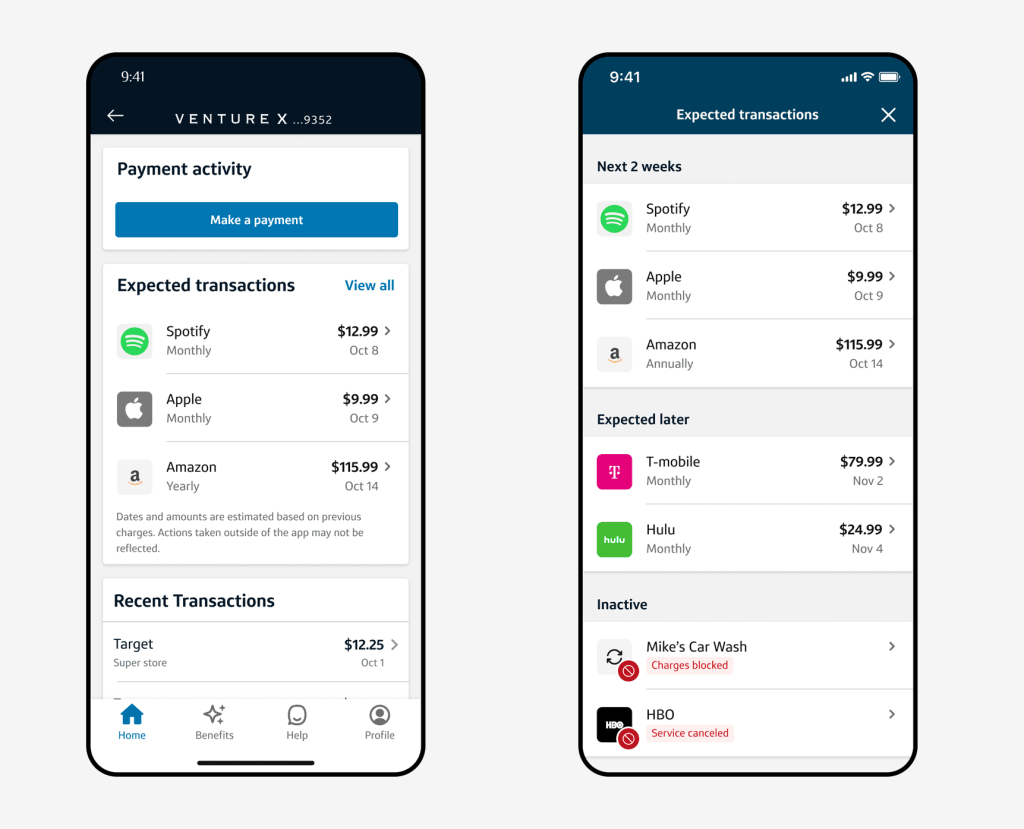

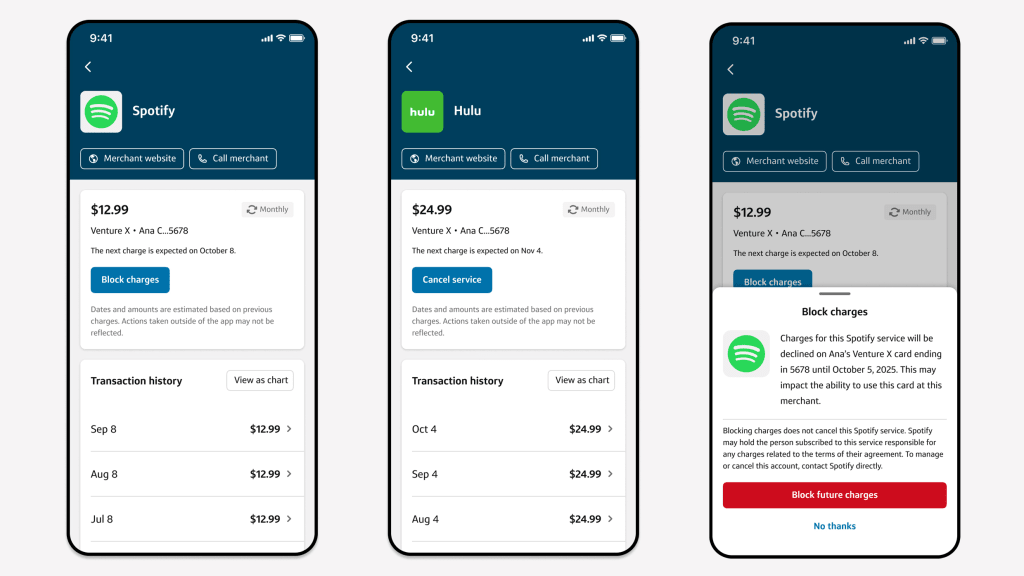

Customers can log into the Capital One app to view a glanceable list of upcoming subscription payments, and can block a charge or cancel a subscription with a few clicks.

Knise emphasizes transparent communication with customers through every step of the process. For example, when blocking a subscription, users are notified that while the charge is blocked, they may still need to contact the merchant directly to cancel the service. Customers have the ability to confirm or provide additional details before any information is sent to the merchant.

The tool leverages machine learning models to accurately identify and categorize recurring charges. Capital One partnered with Minna Technologies, an embedded subscription management company, to ensure that any data shared with merchants during the cancellation process is minimal and secure, according to Knise.

Overcoming Challenges

One of the team’s primary hurdles was ensuring seamless integration with a wide range of merchants, each with their own unique billing structures and policies across different verticals.

“Specifically, we adapted how to use data to both identify as well as action customers’ requests to block or cancel to ensure the best outcomes for our customers,” Knise says.

Another challenge was ensuring that the models were able to correctly identify when a charge was a subscription, as opposed to somewhere that a customer shopped regularly, Knise says.

“We were committed to building this capability with proprietary technology as well as deeply integrating it into our existing experience,” he says. “While it required quite a bit of investment in the upfront, we feel that the superior, and difficult to replicate, customer experience was well worth the effort.”

Autentifică-te pentru a adăuga comentarii

Alte posturi din acest grup

Worried about getting canceled? There’s now insurance policy for that.

Insurance agency Samphire Risk is rolling out “cancel culture” insurance for celebrities and execs afraid of social

The Army helicopter and regional American Airlines jet that collided over Washington are both workhorse aircraft that operate around the world on a daily basis.

There were 60 passengers

In early 2024, Ryan Broderick, a surgeon at UC San Diego Health, was commiserating with some colleagues about the profusion of screens in today’s operating rooms. Though the displays provided essen

Welcome to AI Decoded, Fast Company’s weekly newsletter that breaks down the most important news in the world of AI. You can sign up to receive this newsletter ever

Microsoft said Wednesday that its profit for the October-December