With Donald Trump set to return to the White House in January, streaming media and consumer electronics companies have to prepare for disruption ahead. Some of Trump’s policies could arguably benefit the industry. For instance, a less aggressive Federal Trade Commission increases the chances of big media mergers, which is good news for Vizio/Walmart, Dish and Directv, as well as anyone else looking to combine forces.

However, looming large over everything else are Trump’s proposed tariffs. Massive levies on imports won’t just hurt consumer electronics makers, but are also poised to negatively impact streaming services. Plus, significant across-the-board price increases could force U.S. consumers to buy less, further impacting an industry that is still dealing with some of the after-effects of the pandemic.

What we know about Trump’s tariff plans

During his campaign for president, Trump said that he would impose tariffs of 10% to 20% on all imported goods, regardless of the country of origin. He also said that imports from China would be subject to 60% tariffs, and suggested he could punish Mexico with tariffs of up to 100% for alleged inaction on migration. At one point or another, he has also floated the possibility of imposing 200% tariffs on U.S. companies moving jobs abroad, and tariffs of more than 200% on cars imported from Mexico.

What this means for consumer electronics

The Trump-world logic for these import taxes is that they strengthen domestic manufacturing. At least for consumer electronics, that’s not supported by evidence. The Consumer Technology Association found in its analysis of tariffs imposed during Trump’s first term that they didn’t result in significant increases of consumer electronics manufacturing in the United States. Instead, companies simply moved their manufacturing from one overseas market to another.

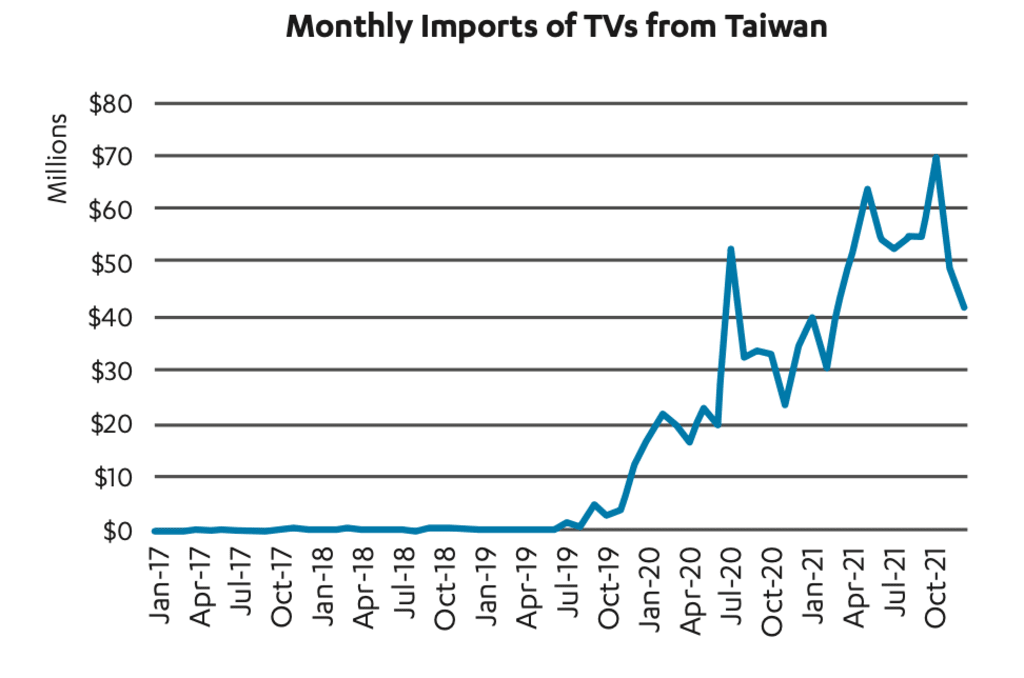

One beneficiary of this in the TV space was Taiwan: In 2017, the U.S. imported $4 million worth of TVs from the country; by 2021, TV imports from Taiwan had grown to $607 million.

Companies will likely continue to shift production from China to other overseas markets to escape the highest levies. However, with Trump planning to impose tariffs on all imports, they won’t be able to escape increased costs altogether. In fact, a lot of manufacturers may actually be subject to tariffs on multiple fronts.

Not only does the price of importing goods from overseas increase, they also have to pay more to make those products in the first place due to retaliatory tariffs imposed by other countries, as Roku explained in its 2020 annual report. “China imposed higher Chinese tariffs on a large amount of U.S. exports to China, which could affect the prices of U.S. origin parts or components of our products assembled in China,” the company noted at the time.

Budget TV makers could be especially susceptible to those trends, as they already operate on razor-thin margins, and frequently have little control over their supply chain. “Certain Roku TV brands do not have internal manufacturing capabilities and primarily rely upon contract manufacturers to build the Roku TV models that they sell to retailers,” Roku noted in the same report. “Their contract manufacturers may be vulnerable to […] increases in U.S. tariffs on imports of Roku TV models [and] foreign tariffs on U.S. parts.”

With costs rising on multiple fronts, consumer electronics companies have to decide whether they eat the difference, or raise prices for consumers. Roku, for instance, may decide to once again sell its hardware below cost, and recoup its losses with the money it makes from ads. Many TV manufacturers on the other hand don’t have the same business model, all but ensuring that they will have to raise prices for their devices.

This is something Netflix co-founder Reed Hastings warned about before the election:

Why streaming services should be worried

Hastings was a vocal backer of vice president Harris’ presidential campaign, but he does have another reason to be concerned about the inflationary impact of tariffs: When TVs and streaming devices get more expensive, sign-ups for Netflix and other streaming services drop.

It’s something Netflix experienced first-hand during the pandemic, when subscriber growth first skyrocketed, only to come to a screeching halt in 2022. One of the reasons for that: Supply chain strains resulted in fewer TV sales, and fewer people picking up new smart TVs resulted in fewer households signing up for Netflix. “Smart TV sales and a bunch of macro factors […] slow that down,” admitted Netflix co-CEO Ted Sarandos at the time.

“Smart TV penetration growth has slowed dramatically, with Netflix sub growth heavily correlated to the growth in smart TV adoption,” noted Lightshed analyst Rich Greenfield at the time. Fellow analyst Paul Erickson, then working for Parks Associates, agreed, telling me in 2022 that “supply constraints […] certainly cause ripple effects in overall subscription growth, as smart TVs are now the most significant point of video aggregation and consumption in U.S. households today.”

Why ads won’t save streamers

Granted, today’s Netflix is not the same company it was in early 2022, just as the overall market has changed significantly. The biggest shift has been the wholesale embrace of advertising; Netflix first launched an ad-supported tier in the fall of 2022, and has since signed up more than 70 million consumers for this plan. This week, the company revealed that more than half of new subscribers now opt for the ad-supported tier.

Most other subscription video services have launched similar ad-supported plans over the past few years. And while those cheaper plans don’t necessarily negate the fact that consumers may buy fewer new TVs once prices increase, they may serve as a bit of a cushion against a possible return of broader inflationary pressures.

The Tax Policy Center estimates that Trump’s proposed 20% tariffs on global imports and 60% tariffs on imports from China could cost U.S. households $3,000 per year on average; some experts believe that the average cost could be as high as $6,000. This will likely accelerate cord cutting even further, an could drive more consumers to opt for ad-supported tiers.

However, higher costs and lower spending power also threatens the overall economic recovery, with the Tax Foundation estimating that Trump’s tariff plans would shrink the GDP by 0.8% and cost 684,000 U.S. jobs even before other countries impose retaliatory tariffs. That could have ripple effects on the ad market, as we saw in recent years: Ad spending growth in the Americas declined from 22.1% year-over-year in 2021 to just 2.5% in 2023, according to Dentsu’s Global Ad Spending Forecast.

Granted, there are still lots of unknowns

How high will the tariffs actually be? Will there be exceptions? To what degree will other countries retaliate? We still don’t know the answers to these questions, and likely won’t until later in 2025. But if the second Trump administration does follow through on Trump’s sweeping tariff proclamations, consumer electronics and streaming media companies could be in for a bumpy ride.

This story originally appeared on Janko’s newsletter Lowpass. Subscribe here.

Autentifică-te pentru a adăuga comentarii

Alte posturi din acest grup

For Makenzie Gilkison, spelling is such a struggle that a word like rhinoceros might come out as “rineanswsaurs” or sarcastic as “srkastik.”

The 14-year-old from

Japan Airlines said it was hit by a cyberattack Thursday, causing delays to

Thumbnails play the YouTube equivalent of a movie poster, aiming to draw your attention to click and watch when you have hundreds of videos clogging your recommended content. Most of us have been

Over the past two years, generative AI has dominated tech conversations and media headlines. Tools like ChatGPT, Gemini, Midjourney, and Sora captured imaginations with their ability to create tex

Was YouTube TV’s recent price increase the straw that broke the camel’s back for you? Wh